What We Do.

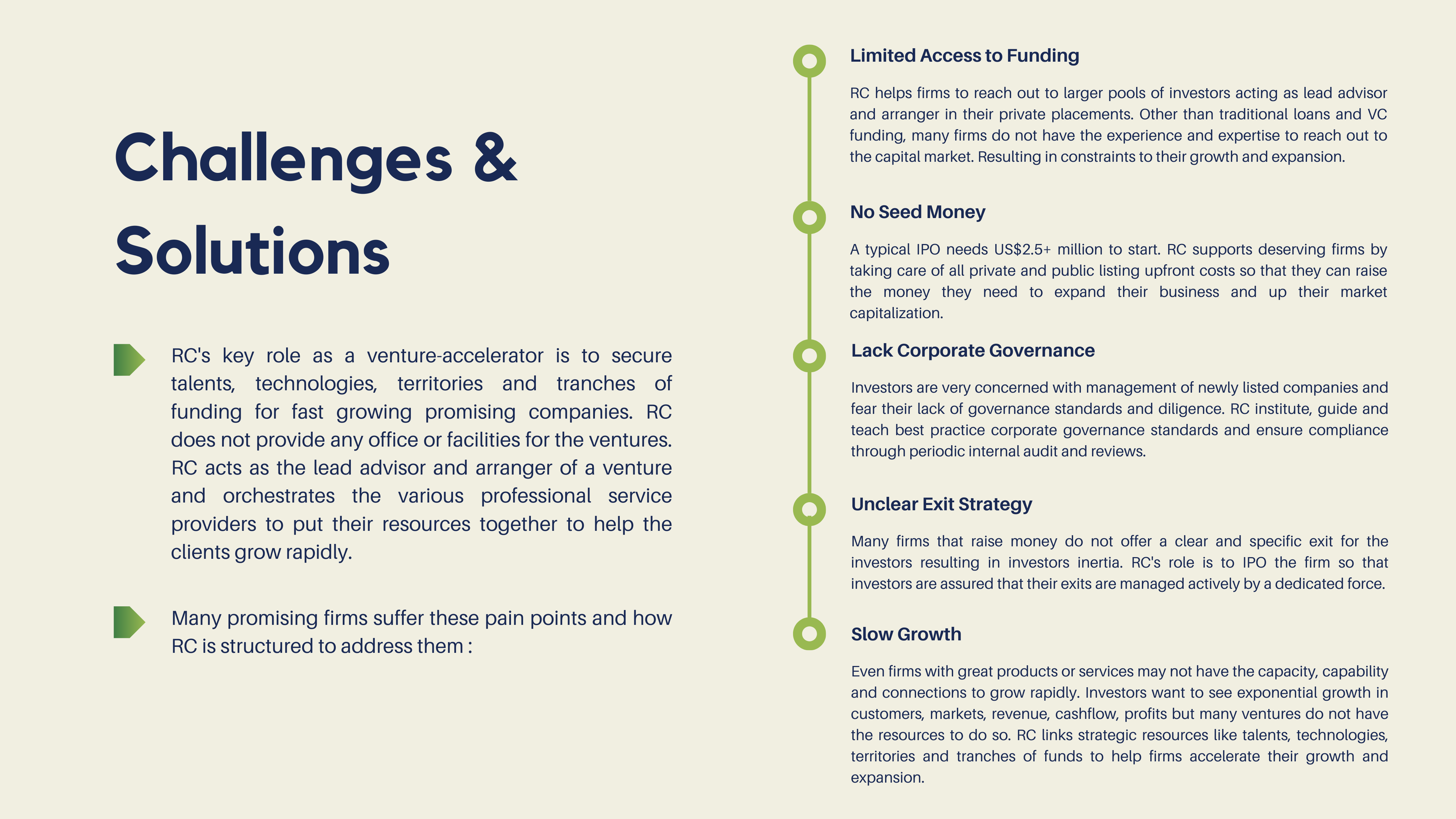

Lots of new and promising businesses are bursting with potential but here's the snag – they have not proven themselves to be successful. And without that track record, getting the resources such as funding, talents and technologies they need to expand is an uphill battle.

Services & Solutions.

Strategy

With team members’ 25+ years of investment and advisory experience, RC provides entrepreneurs and their firms with comprehensive strategic counsel aimed at guiding them toward sustainable growth and long-term success. This includes assistance in analysing market trends, identifying growth opportunities, assessing competitive landscapes, and formulating robust strategies tailored to the unique needs and objectives of each client. Whether it’s entering new markets, launching innovative products, or optimising operational efficiencies, RC leverages its wealth of experience and industry insights to help clients navigate complex strategic challenges and capitalise on emerging opportunities.

funding

Through RC associate firms that specialise in corporate finance and fund management, RC offers a full spectrum of funding solutions to support entrepreneurs and fast-growing companies at every stage of their venture journey. This includes access to a diverse network of institutional investors, venture capitalists, private equity firms, family offices, and strategic partners who are actively seeking investment opportunities in promising ventures. Whether it’s seed capital, growth equity, or financing, RC provides customised corporate and finance solutions tailored to the specific capital needs and growth objectives of each client. Additionally, RC’s deep expertise in structuring and executing financing transactions ensures that clients receive optimal funding terms and favourable investment terms.

Talents with Technologies

In today’s fast-paced business landscape, access to top talent and cutting-edge technologies is essential for driving innovation and to get that competitive edge. RC actively seeks out talented individuals and technology-driven startups who possess disruptive innovations and transformative ideas with the potential to revolutionise industries. Through strategic partnerships and investment collaborations, RC provides these entrepreneurs with the financial resources, industry expertise, and market access they need to accelerate product development, scale their businesses, and achieve commercial success. Additionally, RC offers flexible financing options, including royalty-based financing, to enable entrepreneurs to access capital without diluting equity ownership.

Exits

Like all value-driven investors, RC follows the investment axiom “Sell before you buy” to mitigate investment risks and maximise returns for investors. For clients facing challenges from their shareholders for a clear exit, RC offers comprehensive exit strategies and solutions tailored to their specific needs and objectives. This includes facilitating strategic mergers and acquisitions, orchestrating secondary market transactions, and structuring divestiture deals to unlock shareholder value and optimise investment returns. Additionally, RC specialises in identifying and executing value-enhancing transactions, such as injecting promising businesses into underperforming publicly listed companies or assisting owners of publicly listed companies in divesting non-core assets or business units so that the client’s business can be vended in. Through its proactive approach and extensive industry network, RC helps clients to navigate complex exits for their shareholders to achieve the desired outcomes for all.